AI-driven Risk Assessment in Insurance Underwriting

Utilize AI to enhance risk assessment and improve insurance underwriting.

Why AI-driven Risk Assessment is Crucial in Insurance

Risk assessment is a critical part of insurance underwriting. It involves evaluating potential policyholders to determine their risk levels and pricing premiums accordingly. Traditional methods often rely on historical data and human judgment, which can lead to inaccuracies and potential losses for insurers.

AI introduces a more data-driven and precise approach to risk assessment. By analyzing large volumes of data, including real-time information, AI can offer more accurate risk predictions. This allows insurers to cater policies more closely to individual risk profiles, minimizing potential losses and enhancing customer satisfaction.

The future of the insurance industry is leaning heavily towards AI integration. Companies that adopt AI-driven risk assessment are likely to see improved efficiency, reduced operational costs, and a competitive edge. As technology continues to advance, the role of AI in risk assessment will become increasingly indispensable.

Why Licode is the Ideal Tool for AI-driven Insurance Solutions

Building AI applications swiftly and effectively is essential in the fast-paced insurance industry. Licode simplifies this by providing non-technical users with the tools to create powerful AI solutions without coding knowledge. Its mission is to empower professionals in insurance to rapidly develop apps that enhance their operations.

Licode facilitates the creation of user-friendly interfaces and custom AI models. These models can leverage various LLMs and in-house data to streamline risk assessments. Licode also allows for easy data storage and automated processes through its intuitive visual builder, ensuring insurers can continuously improve their services.

Why use Licode

Key Advantages of Using Licode

User-friendly Interface

Licode's drag-and-drop interface makes it easy for anyone to build and customize AI apps, regardless of their technical skills.

Comprehensive AI Model Integration

Integrate multiple AI models seamlessly into your risk assessment process, leveraging the power of advanced LLMs and your own data.

Effortless API Integration

Easily connect with existing insurance software and tools via API to streamline processes and improve efficiency.

Steps to Develop an AI-powered Risk Assessment App

- Create an account on Licode. This is the first step to accessing Licode's no-code platform and starting your AI app journey.

- Prepare your resources. Gather necessary data, such as policyholder information and historical claims, in formats like doc and csv.

- Build your app's interface. Use Licode's drag-and-drop builder to design a user-friendly interface tailored to your needs.

- Customize the AI model. Choose from various LLMs and incorporate your own data to enhance the risk assessment process.

- Add extra features. Consider integrating reporting tools, notifications, or user management functions to add value to your app.

- Market your solution. Promote your app to potential users using relevant marketing channels to increase uptake and utilization.

Enable AI in your app

Licode comes with built-in AI infrastructure that allows you to easily craft a prompt, and use any Large Lanaguage Model (LLM) like Google Gemini, OpenAI GPTs, and Anthropic Claude.

Supply knowledge to your model

Licode's built-in RAG (Retrieval-Augmented Generation) system helps your models understand a vast amount of knowledge with minimal resource usage.

Build your AI app's interface

Licode offers a library of pre-built UI components from text & images to form inputs, charts, tables, and AI interactions. Ship your AI-powered app with a great UI fast.

Authenticate and manage users

Launch your AI-powered app with sign-up and log in pages out of the box. Set private pages for authenticated users only.

Monetize your app

Licode provides a built-in Subscriptions and AI Credits billing system. Create different subscription plans and set the amount of credits you want to charge for AI Usage.

Accept payments with Stripe

Licode makes it easy for you to integrate Stripe in your app. Start earning and grow revenue for your business.

Create custom actions

Give your app logic with Licode Actions. Perform database operations, AI interactions, and third-party integrations.

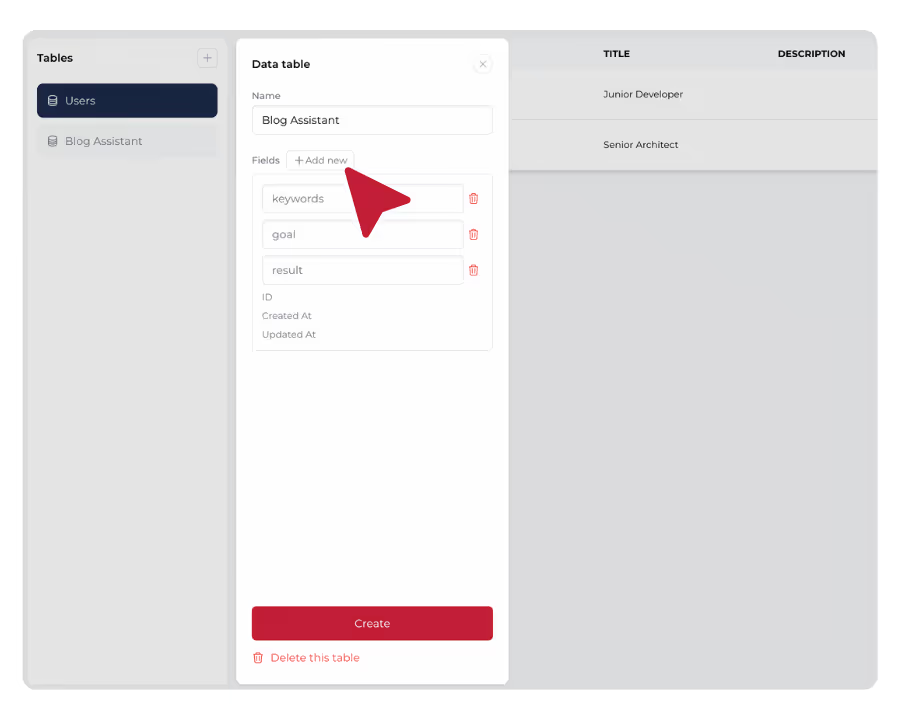

Store data in the database

Simply create data tables in a secure Licode database. Empower your AI app with data. Save data easily without any hassle.

Publish and launch

Just one click and your AI app will be online for all devices. Share it with your team, clients or customers. Update and iterate easily.

Browse our templates

StrawberryGPT

StrawberryGPT is an AI-powered letter counter that can tell you the correct number of "r" occurrences in "Strawberry".

AI Tweet Generator

An AI tool to help your audience generate a compelling Twitter / X post. Try it out!

YouTube Summarizer

An AI-powered app that summarizes YouTube videos and produces content such as a blog, summary, or FAQ.

Don't take our word for it

I've built with various AI tools and have found Licode to be the most efficient and user-friendly solution. In a world where only 51% of women currently integrate AI into their professional lives, Licode has empowered me to create innovative tools in record time that are transforming the workplace experience for women across Australia.

Licode has made building micro tools like my YouTube Summarizer incredibly easy. I've seen a huge boost in user engagement and conversions since launching it. I don't have to worry about my dev resource and any backend hassle.

FAQ

How does AI enhance the risk assessment process in insurance?

AI enhances the risk assessment process by analyzing vast amounts of data quickly and accurately. It identifies patterns and correlations that might not be visible to human underwriters. This ability to process real-time information means insurers can dynamically adapt to shifting risk factors, leading to more precise premium calculations and tailored insurance products. With AI's predictive power, insurers can better forecast potential claims, ultimately reducing the incidence of false positives and negatives in risk assessment. Overall, integrating AI leads to improved operational efficiency, reduced costs, and increased customer satisfaction.

Can anyone use Licode to build an AI app for insurance underwriting?

Yes, Licode is designed to be accessible to users of all skill levels, including those without any technical background. Its no-code platform allows users to build AI applications through an intuitive interface featuring drag-and-drop functionality. Marketing professionals, business analysts, and other non-IT roles in the insurance sector can use Licode to create sophisticated AI-driven tools to streamline their processes. Licode's resources and customer support provide additional guidance and troubleshooting to ensure a smooth development experience.

What types of data can be used in AI-driven risk assessment?

In AI-driven risk assessment, a wide range of data types can be utilized. These include structured data like numerical and categorical information sourced from policyholder records and historical claims data. Unstructured data, such as text from social media, customer interactions, and other qualitative sources, can also be analyzed. By leveraging a variety of data formats, AI models can generate comprehensive risk profiles for underwriting. This diverse data intake enables the development of nuanced insights, ultimately leading to more informed decision-making in the insurance underwriting process.

How does Licode ensure data privacy and security?

Licode places a strong emphasis on data privacy and security, ensuring compliance with industry standards and regulations. The platform incorporates robust encryption techniques to protect data stored within its databases. Moreover, Licode provides users with options to manage access permissions and monitor activities within their AI applications. Its commitment to maintaining high security standards means that companies can trust Licode to handle sensitive information such as policyholder data. The platform's security measures are continually reviewed and updated to safeguard against emerging threats, providing peace of mind to users concerned about data protection.

Do I need any technical skills to use Licode?

Not at all! Our platform is built for non-technical users.

The drag-and-drop interface makes it easy to build and customize your AI tool, including its back-end logic, without coding.

Can I use my own branding?

Yes! Licode allows you to fully white-label your AI tool with your logo, colors, and brand identity.

Is Licode free to use?

Yes, Licode offers a free plan that allows you to build and publish your app without any initial cost.

This is perfect for startups, hobbyists, or developers who want to explore the platform without a financial commitment.

Some advanced features require a paid subscription, starting at just $20 per month.

The paid plan unlocks additional functionalities such as publishing your app on a custom domain, utilizing premium large language models (LLMs) for more powerful AI capabilities, and accessing the AI Playground—a feature where you can experiment with different AI models and custom prompts.

How can I monetize my AI app?

Licode offers built-in monetization tools that make it simple to generate revenue. You can create subscription plans, set up tiered access, or offer one-time payments for extra AI credits or premium features.

Monetization is powered by Stripe, ensuring secure, seamless payments. Setting up your Stripe account takes only a few minutes, so you can start earning quickly with minimal effort.

Is my data safe with Licode?

We take data security and privacy very seriously with Licode.

All data stored in your app's databases and in your AI model's instructions are encrypted and cannot be retrieved by our teams or by the LLM providers like OpenAI, Google, and Anthropic.

We have implemented GDPR-compliant rules within our systems to ensure that you can always reclaim all data you have uploaded, and that none of your information can be accessed without your prior consent.

In addition, we work with cybersecurity professionals to ensure that all data is hosted and encrypted on a secure server managed by AWS.

How do I get started with Licode?

Getting started with Licode is easy, even if you're not a technical expert.

Simply click on this link to access the Licode studio, where you can start building your app.

You can choose to create a new app either from scratch or by using a pre-designed template, which speeds up development.

Licode’s intuitive No Code interface allows you to build and customize AI apps without writing a single line of code. Whether you're building for business, education, or creative projects, Licode makes AI app development accessible to everyone.

What kind of experience will my audience have with the AI app?

Your app will feel like a personalized extension of your content.

Users can interact with the AI based on the resources you provide, making the experience feel like they’re engaging directly with your expertise.